Mediterranean CE Data

Testing Phase - Main Conclusions

The BLUEfasma testing phase aimed to:

- Tackle the lack of data on the circularity level of Mediterranean SMEs and maritime clusters/networks related to fishing and aquaculture;

- Foster exchange of information about existing situation on Circular Economy;

- Improve the knowledge on Circular Economy and map the circularity level in the engaged territories.

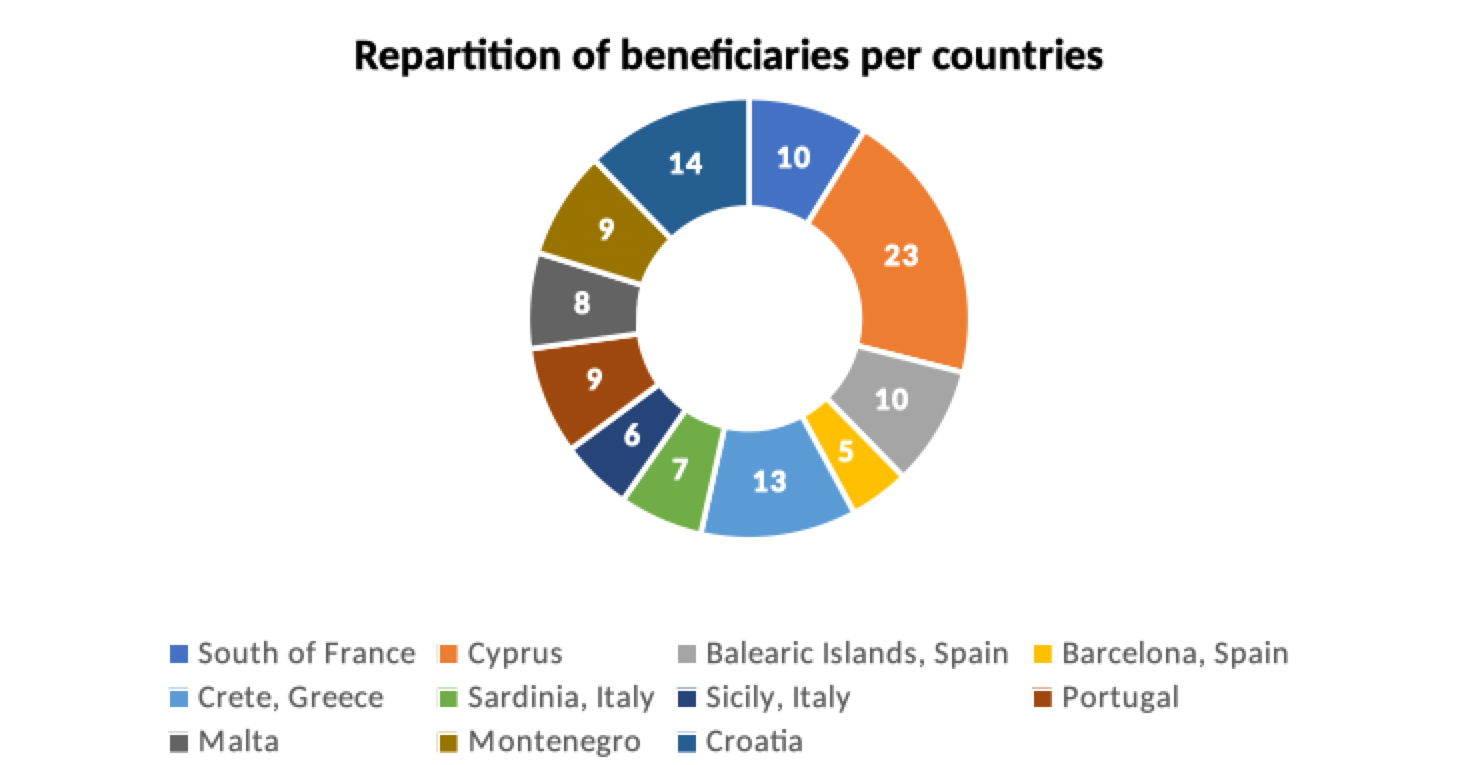

Testing activities were implemented in order to estimate the Mediterranean stakeholders’ level of circularity. The partnership located in 9 countries was in charge of testing the Mediterranean CE readiness index in their respective territories. The testing phase involved in total 114 stakeholders acting in the aquaculture and fishing value chain.

Mediterranean stakeholders’ level of circularity

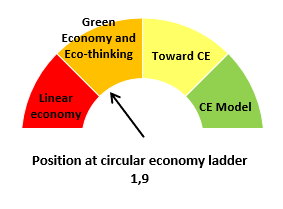

The results highlight that the Mediterranean stakeholders’ level of circularity in the fishing and

aquaculture sectors is rather low. Fishing and aquaculture remain traditional sectors, based on a

traditional linear model. This model is wasteful and is consuming a lot of natural resources.

The average Circular Economy Readiness Index is 1.9/4.0, which means that the companies follow green

economy and eco-thinking in their businesses.

Two concrete examples

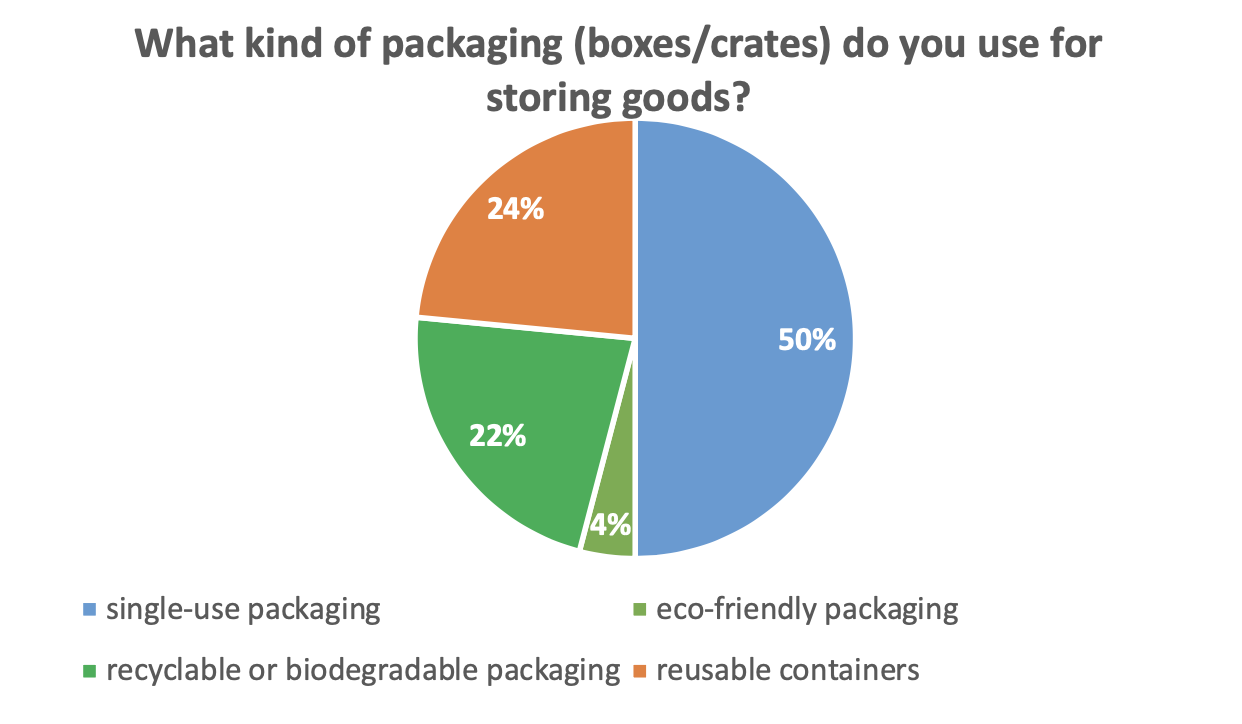

Packaging: Half of the stakeholders interviewed are

making efforts in terms of packaging to move towards Circular Economy: 24% are using reusable containers,

22% recyclable or biodegradable packaging and 4% eco-friendly packaging. The other half is still using

single-use packaging for storing goods.

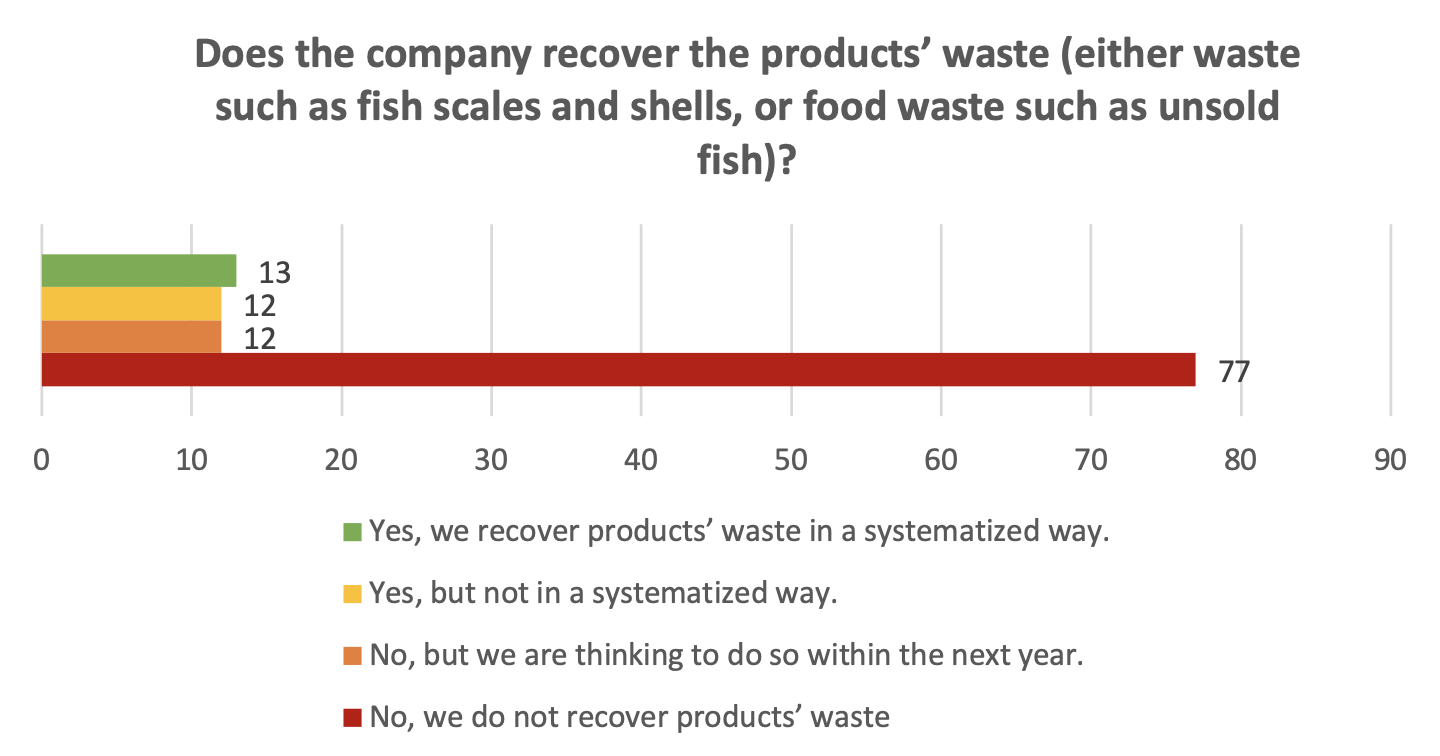

Waste: Waste as fish scales, shells and unsold fish are

not often recovered by companies.

Only 13 beneficiaries against 77 are recovering products ‘waste in a systematised way. These companies

are using residues as fertiliser or animal feed. The valorisation of waste such as fish scales and

shells can be a way of boosting Circular Economy in the Mediterranean area.

Several difficulties to move towards Circular Economy practices were highlighted during this testing phase:

| Lack of knowledge on the Circular Economy process | There is a general lack of awareness about Circular Economy initiatives and the benefits they can bring to companies. This is linked also to the lack of awareness of the real meaning behind “Circular Economy”. Indeed, some circular practices are implemented without being labelled as such. Therefore, there is a need for clarification on the definition, goals, and advantages of Circular Economy principles. |

| Most of the beneficiaries are small and independent | This mainly concerns fishermen and small aquaculture farms. Most of them are small and independent and thus have limited control over waste flows. For instance, the use of crates is often governed by the purchasing company and this gives little control over the use of recycled crates and managing processing waste. |

| Lack of financial resources | One of the biggest obstacles is economic investment. Investing in alternative practices or technologies, such as eco-friendly vessels implies a level of investments that small companies cannot usually reach. Additionally, there is often a lack of knowledge regarding financial aid which can support them in their shift towards Circular Economy. |

| Lack of administrative support | Another difficulty is the lack of assistance with the administrative procedures for financial aid or installation support. Stakeholders need to be guided for the implementation of Circular Economy in their activities. However, they have the feeling that there is not enough involvement of the different public administration stakeholders related to the sectors. There is a need for support in the implementation of CE. |

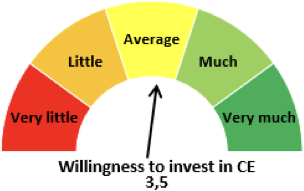

Willingness to invest in Circular Economy

Among the stakeholders interviewed, there is a general awareness that there should be a more rational

use of raw materials benefiting the environment. Most of them are receptive and ready to invest and

would like to find more ecological alternatives. The average grade for willingness to invest in CE

is really encouraging: 3,5/5.0.

Fishing and aquaculture are blue economy sectors with a huge potential to move towards

circularity. Improvement can be done at all stages of product life. Key challenges in the

sector are summarised in the following table:

| Eco-design |

|

| Production |

|

| Use |

|

| Recycling |

|